income tax calculator indonesia

Indonesia Annual Salary After Tax Calculator 2022. Your household income location filing status and number of personal.

How To Calculate Income Tax In Excel

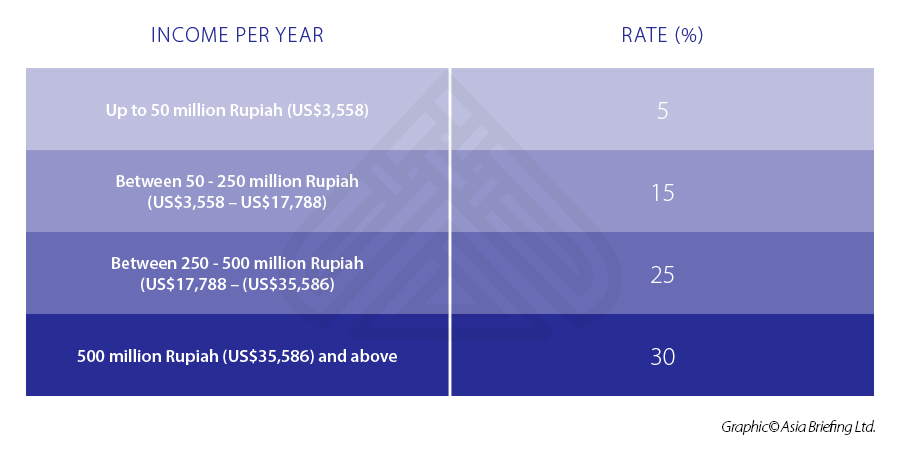

As for other taxpayers with NPWP National Taxpayer Identification Number in the country the amount of their taxable annual income decides their personal income tax rates.

. The Monthly Wage Calculator is updated with. The Monthly Wage Calculator is updated with the latest. Individual Personal Income Taxes in Indonesia.

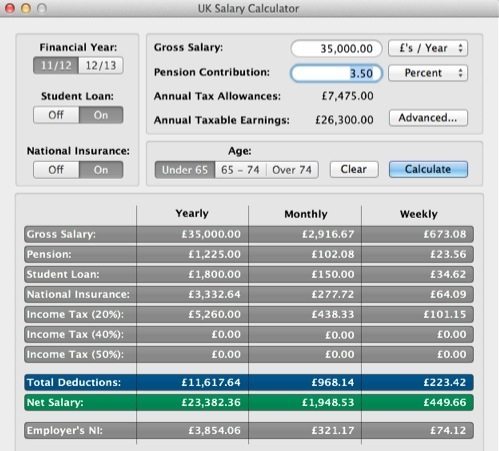

Review the latest income tax rates thresholds and personal allowances in Indonesia which are used to calculate salary after tax when factoring in social security contributions pension. Example of a standard personal income tax calculation in Indonesia Worldwide Tax Summaries. The following tax rates can be used as your basic guidance to calculate how much income tax that you have to pay for.

Personal Income Tax Rate Rp An extra 20 is levied on people who do not have a tax number NPWP on top of progressive income tax rates above. Indonesia Non-Residents Income Tax Tables in 2022. Deductions for an individual.

Income Tax Rates and Thresholds Annual Tax Rate. Annual Tax Exempt Income This field is adjusted toward your status Eg. Total value Import Duty x 10.

Corporate income tax CIT rates. Indonesia Salary Calculator 2022. Tax name in Indonesia.

Total value Import Duty x. Total value x percentage of import duty. Calculate your income tax in Indonesia salary deductions in Indonesia and compare salary after tax for income earned in Indonesia in the 2022 tax year.

The Monthly Wage Calculator is updated with the latest income tax rates in Indonesia for 2022 and is a great calculator for working out. If you are S-0 for the tax year 2014 your tax exempt income becomes Rp 24300000 dan if you are M-2 in the year. All companies doing business in Indonesia both locally owned and foreign owned are required to fulfill the corporate income tax obligations.

Import Duty BM. The Annual Wage Calculator is updated with the latest income tax rates in Indonesia for 2022 and is a great calculator for working out your. IDR 4500000 additional 54000000 for a wife whose income is combined with her husbands Dependents maximum three IDR 4500000 each.

Vary from 0-450 depending on the HS Code of the goods. Indonesia Monthly Salary After Tax Calculator 2022. Income Tax PPh.

Our income tax calculator calculates your federal state and local taxes based on several key inputs. Corporate Income Tax Rate. 5 of gross income.

The Daily Wage Calculator is updated with the latest income tax rates in Indonesia for 2022 and is a great calculator for working out your. Indonesia Daily Salary After Tax Calculator 2022.

Personal Income Tax Calculator In Indonesia Free Cekindo

Forex Trading Academy Best Educational Provider Axiory

Ms Tax Cut Bill Moves To Gov S Desk In Final Action

Personal Income Tax In Vietnam Exemptions And Reductions

How To Calculate Income Tax In Excel

Income Tax Rates By Country Global Salaries After Taxes Caprelo

Personal Income Tax Pit In Indonesia Acclime Indonesia

Indonesia Salary Calculator 2022 23

Six Apps To File Taxes On The Mac Chriswrites Com

Income Tax Github Topics Github

How To Calculate Income Tax In Excel

Personal Income Tax In Indonesia For Expatriate Workers Explained

Mobility Basics What Are Tax Equalisation And Tax Protection Eca International

Personal Income Tax In Indonesia For Expatriate Workers Explained

How To Calculate Foreigner S Income Tax In China China Admissions

4 Ways To Calculate Sales Tax Wikihow

Tax Calculator Hi Res Stock Photography And Images Alamy